Open Banking in the United States: Exploring the Benefits and Challenges for Financial Institutions and Consumers

Introduction

Open banking is a relatively new concept that has gained popularity in recent years, especially in Europe and Asia. It has been touted as a means of increasing competition in the financial industry, fostering innovation, and enhancing the customer experience. The concept is predicated on the idea that customers should have control over their own financial data and be able to share it with third-party providers who can use it to offer new and innovative financial products and services. Open banking is a game-changing concept. The global open banking market was valued at $13.9 billion in 2020, and is projected to reach $123.7 billion by 2031, growing at a CAGR of 22.3% from 2022 to 2031.

However, Open banking has been slow to catch on in the United States due to regulatory obstacles and the fragmented nature of the banking industry. The U.S. Consumer Financial Protection Bureau (CFPB) plans to propose an «open banking» rule in 2023 and finalize it only in 2024. It can dramatically boost competition in the consumer finance industry and increase Americans’ access to financial services.

In contrast to Europe, where the EU’s Payment Services Directive 2 (PSD2) has paved the way for open banking, there is no explicit federal law in the United States that permits or regulates open banking. This necessitates that financial institutions navigate a complex web of state and federal regulations to ensure legal compliance.

“Open Banking continues to power through its way into the financial services industry, as initiatives across the world gain momentum, encouraging competition and innovation”. The Paypers.

Another barrier to the adoption of open banking in the United States is the fragmented character of the banking industry. In the United States, there are numerous banks and financial institutions, each with its own technology platforms and data systems. This makes it challenging for third-party providers to access and utilize consumer data, as they must negotiate separately with each bank to gain access to their data systems.

Open banking is gaining traction on the US market despite these obstacles, thanks to the proliferation of fintech ventures and the rising demand for digital services. Fintech startups have been at the forefront of the open banking movement, offering innovative new financial products and services that leverage consumer data to provide more personalized and efficient financial services. In order to maintain market competitiveness, traditional financial institutions are therefore under pressure to implement open banking.

The concept of open banking has substantial potential benefits for both financial institutions and consumers. By granting third-party providers access to bank data, financial institutions can generate new revenue streams, boost efficiency, and acquire a competitive edge. In return, consumers can reap the benefits of more personalized financial services, more options, and reduced prices. However, open banking presents obstacles, such as data privacy and security concerns, regulatory compliance issues, and the need for technology integration. As the US financial industry continues to evolve, it will be necessary to carefully consider these challenges and opportunities in order to completely realize the potential of open banking.

Open Banking APIs

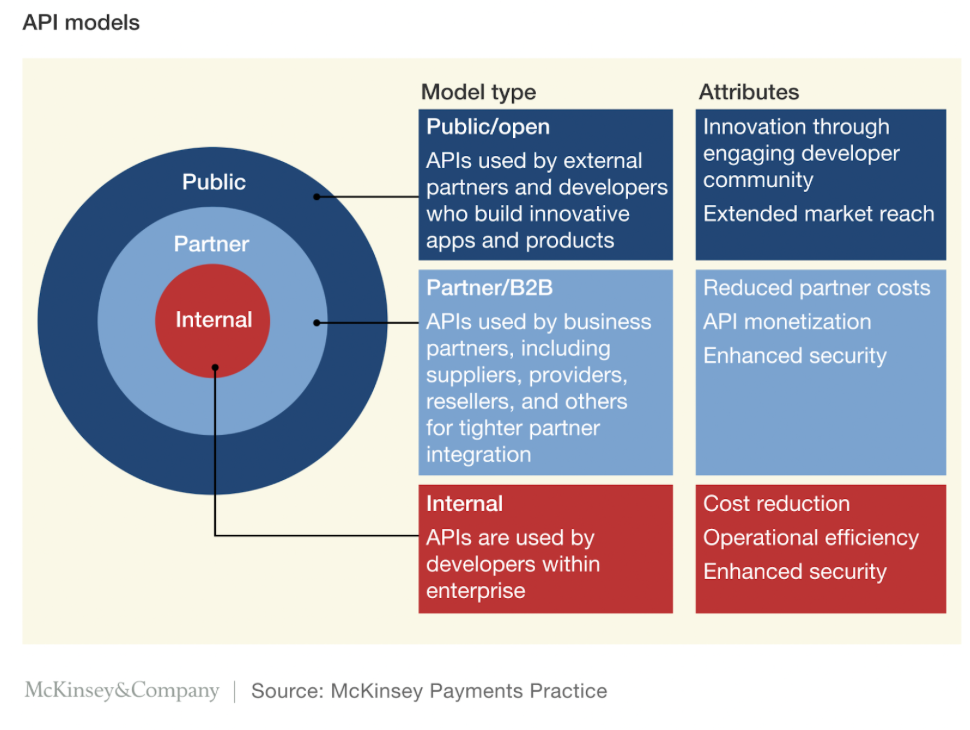

APIs, or Application Programming Interfaces, are crucial to open banking. APIs enable software systems to communicate and share information in a standardized and secure manner. APIs enable financial institutions to securely share customer data with third-party providers in the context of open banking. This data may include account balances, transaction histories, and other financial information.

The use of APIs in open banking enables third-party providers to gain real-time access to customer data, which can be used to offer new and innovative financial services. A third-party provider could, for instance, use a customer’s transaction history to offer a personalized budgeting tool that suggests ways to save money based on the customer’s spending habits. Alternatively, a wealth management firm could use a client’s financial information to provide investment advice that is tailored to their specific needs and risk tolerance.

Open banking also permits customers to grant third-party providers access to their financial information, which can be used to develop personalized financial services. Typically, this is accomplished through a procedure known as «consent management,» in which the customer grants explicit permission for the third-party provider to access their data. Consent management ensures that customers have control over their own financial data and can select which third-party service providers they wish to share it with.

The ability to create personalized financial services is a significant advantage of open banking. Third-party providers can gain insight into a customer’s spending habits, financial goals, and risk tolerance by gaining access to their financial information. This allows them to offer customized financial services catered to the specific needs of each customer.

The use of APIs in open banking can also result in increased efficiency and decreased costs for financial institutions. Financial institutions can reduce the need for manual processes and improve data accuracy by automating the process of sharing customer data with third-party providers. This can result in cost reductions and enhanced customer service.

Open banking APIs are an essential facilitator of the benefits open banking can offer to both financial institutions and consumers. By sharing consumer data with third-party providers in a secure manner, financial institutions can generate new revenue streams, improve efficiency, and offer more personalized financial services to customers. Open banking can offer consumers more options, lower costs, and more personalized financial services that are tailored to their particular requirements and goals.

Open Banking Services

Open banking services can include a wide range of financial products and services, including:

- Payment services: Third-party providers can use open banking APIs to create new payment solutions that are faster and more convenient than traditional payment methods.

- Personal finance management: Open banking APIs can be used to create personal finance management tools that help customers manage their money more effectively.

- Investment services: Third-party providers can use open banking APIs to offer investment services that are tailored to the customer’s financial goals and risk tolerance.

- Credit services: Open banking APIs can be used to create new credit products that are more accessible and affordable than traditional credit products.

- Identity verification: Open banking APIs can be used to verify a customer’s identity and reduce the risk of fraud.

Benefits of Open Banking for Financial Institutions

Open banking offers several advantages to financial institutions willing to adopt the concept. Some of the most important advantages of open banking for financial institutions include:

New revenue streams

By sharing customer data with third-party service providers in a secure manner, financial institutions can generate new revenue streams by offering new and innovative products and services. This can include partnerships with fintech startups or other financial institutions in which data and technology are combined to offer customers new financial products.

Improved customer experience

Open banking allows banks to tailor their services to each individual customer’s needs. Insights about customers’ wants, requirements, and spending habits can be gleaned from their data and used to better serve them by financial institutions. This allows them to give each consumer individualized attention and better financial services.

Increased efficiency

By automating some tasks and improving the quality of data, open banking can help financial organizations work more efficiently. APIs allow for the instantaneous exchange of data and the implementation of automated procedures, both of which improve efficiency and ultimately benefit the customer experience.

Competitive advantage

Financial organizations can gain a competitive edge through open banking. Financial institutions can differentiate themselves from competitors and enhance their market share by delivering new financial services and forming partnerships with third-party providers.

In addition to these advantages, open banking enables financial institutions to expand their customer base and reach. Financial institutions can gain access to new markets and customers that they may not have been able to reach on their own through partnerships with third-party providers. This can result in increased revenue and expansion prospects for financial institutions.

Open banking offers a number of advantages to financial institutions that are willing to adopt the concept. By adopting open banking, financial institutions can generate new revenue streams, enhance the customer experience, boost efficiency, and gain a market advantage.

Challenges of Open Banking for Financial Institutions

Open banking offers a number of advantages to financial institutions, but it also presents a number of challenges that must be addressed. The following are some of the most significant challenges of open banking for financial institutions:

Financial institutions are obligated to ensure that customer data is secure and protected from unauthorized access. This includes implementing robust security measures and protocols to prevent data breaches and ensuring that third-party providers comply with data privacy and security regulations as well.

Financial institutions are required to comply with a variety of regulations pertaining to data privacy, consumer protection, and financial services. These regulations may vary by jurisdiction, making it challenging for financial institutions to navigate the regulatory environment.

“While open banking stands to benefit end users as well as to foster innovations and new areas of competition between banks and nonbanks, it is also likely to usher in an entirely new financial services ecosystem, in which banks’ roles may shift markedly. It also raises issues around regulation and data privacy, which helps to explain why global markets have taken varying approaches to governance, contributing to disparate levels of progress.” McKinsey

Integration between a bank’s internal systems and those of external vendors is a complex and time-consuming procedure. This could require creating application programming interfaces (APIs) and other technological solutions to guarantee that data is sent in a standardized, interoperable format while remaining securely private.

In order to gain their clients’ confidence, banks must be open and honest about the information they collect and how it is used. One way to do this is through consent management methods that give customers a say in how their data is used.

In order to address these obstacles, financial institutions must invest in technology and talent to ensure that they can support open banking initiatives. Financial institutions must also implement robust security and compliance programs to safeguard customer information and meet regulatory requirements.

In addition to these obstacles, there may also be cultural and organizational obstacles to implementing open banking initiatives. To fully realize the benefits of open banking, financial institutions may need to undergo significant changes to their business processes and operating models. This may necessitate a substantial investment and an openness to change and innovation.

Overall, open banking presents a number of obstacles for financial institutions, but overcoming these obstacles can result in substantial gains. By placing a premium on data privacy and security, regulatory compliance, technology integration, and customer trust, financial institutions can lay the groundwork for successful open banking initiatives that promote growth, innovation, and enhanced customer experiences.

Benefits of Open Banking for Consumers

Open banking provides significant benefits to consumers by granting them access to a broader range of financial services and delivering more personalized, customized financial advice. Some of the most important consumer benefits of open banking include:

More choice

With open banking, customers have access to more banking options, which may help them choose services and solutions that better meet their needs. Consumers are no longer restricted to the services of their single financial institution but can shop around for competitively priced banking, investing, and insurance goods from a number of different vendors.

Personalized services

With open banking, third-party providers can gain access to customers’ banking information and use it to better serve those customers by offering more relevant and useful services and products. Financial services that help individuals better manage their money include investment advice tailored specifically to their needs, budgeting resources, and other similar offerings.

Improved transparency

Through open banking, customers can get a more accurate view of their financial standing. Consumers who have instantaneous access to their financial information are better able to keep tabs on their spending and spot problem areas. When customers are given the option to disclose their information to third-party service providers, they can learn more about the various financial options accessible to them.

Lower costs

Increased competition and lower barriers to entry for new service providers are two ways in which open banking can reduce the cost of financial services. Consumers may reap the benefits of cheaper fees and better rates as banks strive to provide the finest products and services.

With open banking, customers have access to more products and services, greater customization, greater clarity, and lower fees. Open banking presents new opportunities, but customers must be aware of the hazards, such as data privacy and security issues, and take precautions to safeguard their financial and personal data when it moves into new environments. It will be increasingly important for customers to weigh the benefits and risks of taking part in open banking programs as the industry develops further.

Conclusion

Open banking presents financial institutions and consumers in the United States with both benefits and challenges. Open banking presents financial institutions with the opportunity to generate new revenue streams, increase efficiency, and gain a competitive advantage; however, it also poses challenges relating to data privacy and security, regulatory compliance, technology integration, and customer trust. Open banking offers consumers more options, personalized services, increased transparency, and lower costs, but it also raises data privacy and security concerns.

As open banking continues to evolve and gain momentum in the United States, it is crucial that financial institutions and consumers collaborate to ensure that the benefits of open banking are realized while addressing the associated challenges. Financial institutions must prioritize data privacy and security, regulatory compliance, and customer trust, while consumers must protect their personal and financial information.

The potential benefits of open banking make it an essential concept to investigate and adopt. Financial institutions and consumers can unlock the full potential of open banking and create a more innovative, efficient, and transparent financial system for all by collaborating to overcome the obstacles.